- in Not Approved by Caroline So

- |

- 2 comments

Is Acorns App A Scam? What’s The TRUTH About This Investment App?

Welcome to My Acorns App Review!

We’re now in a time where technology is rampant that even money-making opportunities can be done over the internet or through mobile devices. Some platforms make investments possible online or even through mobile apps.

Quick Summary:

Acorns is an investment app that is more of the “spare change investment”. It lets people automatically invest their spare change by rounding up the purchases made with a linked credit or debit card.

It also offers retirement savings accounts, a debit card, and other basic banking services. You can also earn bonus investments if you shop with their Found Money partners.

Overall Rating: 3/10

Recommended: Yes/No

Having said that, we will now be discussing an app that offers a means of investing and it’s called the Acorns!

Is this legit or just another scam? If it is legitimate, is it worth your time and money? How much can you make from this program? Let’s find out everything you need to know in this honest Acorns App review.

What Is Acorns App About?

Acorns app is a micro-savings or investment app that was launched in 2014. It was made available for both IOS and android devices, though the company ultimately launched a web version.

The company, Acorns, was an American financial technology and financial services company. It is based in Irvine, California USA. Acorns specialize in micro-investing and robo-investing.

Originally, the company was launched in 2012 by father and son tandem of Walter Wemple Cruttenden III and Jeffrey James Cruttenden with a purpose to promote incremental and passive investing.

They have established these default “smart portfolios” for investment, which were built with the help of Harry Markowitz, father of Modern Portfolio Theory.

How Acorn App Works?

To start in Acorns and begin investing as a member, you have to sign-up in an Acorns App or through their web platform, fill in the important details needed. Upon account creation, the user will select one of the several pre-built portfolios to invest in and connect it with a debit or credit card.

Acorns App works by letting people automatically invest their spare change by rounding up the purchases they make with a linked credit or debit card.

It encourages investors to invest their spare change using a system it calls "round-ups." It works in every purchase the user makes, rounding up the price to the next whole dollar and the remainder is invested in the selected portfolio.

The Acorns system monitors your bank account and automatically invests the change from your daily purchases. Along with the user-friendly feature, the “save your spare change” feature is also Acorns’ key selling point.

How To Make Money With Acorns App?

Acorns give you an option to choose only between their default “smart portfolios” which are based on your savings goals and risk tolerance :

- Conservative

- Moderately conservative

- Moderate

- Moderately Aggressive

- Aggressive

The portfolios are invested in a combination of stocks, bonds, and real estate. The Conservative is 80% bonds, 18% stocks, and 2% real estate, while the Aggressive is 90% stocks and 10% real estate.

Well, you can alternately choose one yourself but Acorns will automatically rebalance your portfolio as the market changes. There are no minimums to set up an Acorns account, but you need $5 to start investing.

Acorns offer three different subscription tiers for life’s financial needs.

- Acorns Lite ($1/month) - This lets you get your personal investment account, built by experts, to invest spare change automatically, invest more every day, earn bonus investments, and grow your knowledge.

- Acorns Personal ($3/month) - The most popular tier, Acorns Personal unlocks the financial wellness system. Get everything that comes with Lite, plus Acorns Later, their retirement account, and Acorns Spend, the only checking account that helps you save and invest every day.

- Acorns Family- ($5/month) - Investment accounts for kids, plus personal investment, retirement, and checking accounts, and exclusive offers and content.

Different accounts in the tiers:

- Invest Automatically - Invests your spare change (if you opt-in) and lets you invest as little as $5 any time or repeatedly into a portfolio of ETFs. Your investments are then diversified across more than 7,000 stocks and bonds, and Acorns automatically balances your portfolio to stay in its target allocation.

- Acorns Later (Retirement Account) - Lets you automatically save for retirement by setting easy Recurring Contributions. When you sign-up, the app recommends the right plan for you based on your goals, employment, and income.

- Acorns Early - For kids

- Acorns Spend - You can save, invest, and earn while you spend using your link account, credit, and debit card. Acorns Spend has no overdraft or minimum balance fees, plus free or fee-reimbursed ATM access nationwide.

- Acorns Found Money - If you shop with their Found Money partners, you'll automatically earn a bonus investment in your Invest account.

Basically Here’s How To Make Money In Acorns:

- Get Started While Young - Acorns allows those 18–23 years of age, regardless of student status, to invest without fees. Monthly subscription fees for students are waived.

- Automate – Add a small and consistent amount of money monthly as Acorns automatically invests your spare change. But as you know, still investment profits are unpredictable, at times the stock market goes up and at times it goes down. So the investment is a risk to take. However, in Acorns, you could start inconsistent little investments or you could as well opt to make larger ones.

- Boost Your Round-Ups - Take advantage of “Round-Ups” or investing your spare change whenever you use a linked card. As I discussed above, Acorns works like a spare change investment that every purchase the user makes is rounded up to the next whole dollar, and the remainder is invested in the selected portfolio. For example, if you buy something for $2.55, Acorns will round it up to $3.00 and the remainder $0.45 will be automatically invested in your account. Now Acorns has taken Round-Ups to a new level. You can elect to boost your “spare change” amount by as much as 10 times. So instead of investing 55 cents, you can invest as much as $5.50 for that single transaction.

- Sign up for Acorns - They offer a signup bonus of $5.

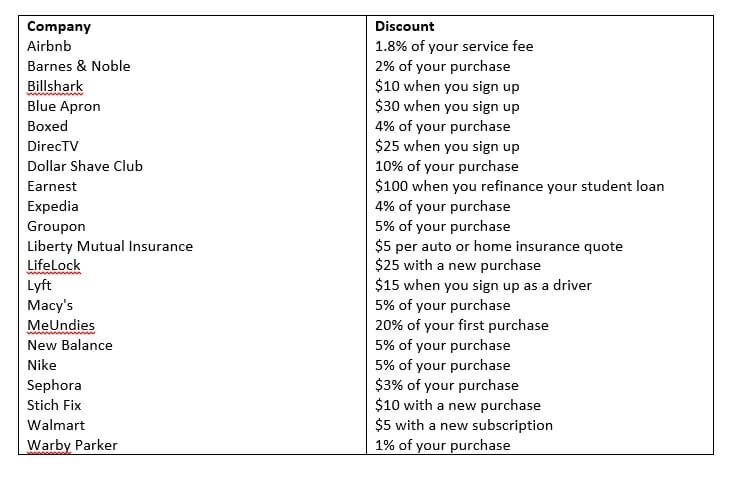

- Using Found Money- Every time you use your Acorns-linked debit or credit card at a selected retailer, that retailer will actually invest a portion into your Acorns investing account and the percentage may vary per retailer as you can see on the partnered retailers below:

The Acorns phone app will give you all the details on the offers currently available. Whenever you shop at one of these partner brands, they'll forward your cashback into your investing account. Typically, it takes about 30 to 60 days to receive your reward. Cash forward is the new cashback.

6. Use Credit Cards With Rewards Points- If you've signed up for Round-Ups and automatic deposits, it’s best to maximize even more by linking your credit cards. Credit cards that have generous rewards programs can actually boost your Acorns benefits.

For instance, you’ll purchase a Starbucks tall latte at $2.95. Acorns will round up 5 cents and invest them in your account, and if you have set your Round-Up booster up to $5, you will be saving even more in your account.

However, if you're using your Starbucks credit card for this transaction, the money from that transaction will also go toward your rewards account, meaning that on top of the extra $2.05 you've put in your Acorns savings account, you're working your way toward free beverages.

Not only you could satisfy your Starbucks craving but you could as well have your savings.

Withdrawing Your Money

Once you have money invested in Acorns, you may want to withdraw some of your Acorn money and withdrawing happens as an electronic deposit into the same checking account your deposits come from. This may take 5-7 business days to be fully available in your account.

To learn more about Acorns App, you can watch the video below:

Is Acorns App A Scam?

Acorns App appears to be a legit investing app. It’s also been operating for several years. It can be an opportunity to help those who are new to investing and for those who don’t really have thousands of dollars to invest.

Also, the other features, such as FoundMoney can help add up to your savings and investment. However, investing is still involved. So there are still risks. You know, investing is gambling through the odds. So, it could really still be uncertain if you could gain a heap of money in the end. Thereby, I’m not recommending you to this one.

Price

Downloading the App is for free, however, to start formally investing, monthly subscription fees are depending on the investment account

- Acorns Lite - ($1/month)

- Acorns Personal - ($3/month)

- Acorns Family- ($5/month)

Plus the minimum investment should start at $5 (minimum investment) but subscriptions are free for students or those who are 18–23 years of age, regardless of student status.

Here Is My Top Recommendation to Start Highly Profitable Online Business from Comfort Of Your Home

Pros/Cons

PROS

Automatic

Well, I like the fact that your investments are done automatically. As Acorns invests your spare change, so at times you may not get to know it but you are already investing and saving up your money.

They also have CashForward or what they say as the new Cashback, as the cashback obtained from purchases made from selected retailers are forwarded as investments in your Acorns account.

CONS

You Could Invest Too Little

Acorns App is a micro-savings app, so it will only take a portion. And if you’ll not opt to set your investments higher, you’ll most likely end up saving only a little, which is still good for those who are conservative investors but if you opt for bigger money-making opportunities, this one is not for you.

Monthly Fee

Though a micro-savings app, Acorns requires a monthly fee which is at $1, $3, and $5. And most probably, the revenue is taken from this membership/ subscription fees.

Investment Is Still Risky

Well, big or small investments, investments are still a risk. Because you can’t predict the stock market, even experts can't do it successfully all the time. It may go up and down. It’s gonna be uncertain.

Tired of Wasting Time on Low Quality Programs?

I'm so grateful that I was able to find THIS PROGRAM which helped me to finally start making money online!

Who Is It For?

Acorns are designed for those who are looking for investment opportunities but don’t have big funds. It’s also probably intended for those who are new to the investing and would need some guidance.

Training Tools/Support

Educational content is available especially for those who are beginning investors. Their website is also very transparent with the details and information you’ll need in starting with Acorns. Customer support is also available where you are free to ask us anything and everything.

Final Opinion/Verdict

Acorns App is not a scam. It’s a legit app suited for those who are beginning with investing or those finding educational content for investments. However, I am still not recommending you to this program.

Yes, you could invest but it will take time earning plus it will be too risky, as all investments are.

You may opt for a savings account or opt into a get-rich scheme platform with these online investment apps but remember that investing is still gambling your luck.

So chances are still uncertain. So, if you’re looking for a money-making opportunity that would give you lucrative income, this is not for you!

What’s Next?

If you’re looking for a source of cash that can turn to passive income in the future, I suggest that you sign up with our top-recommended program.

Join now and take advantage of the following tools and support:

- A proven strategy to work smart and earn a lot (literally)

- Step-by-step guidance

- Best possible support including your training coach

- Lots of training resources

- And so much more!

Remember, making money online or even traditionally is not easy but with consistency and hard work, you can surely get the success you deserve.

Thank you for reading our Acorns App review! If you have questions or comments, please feel free to share it below.